Faster decisions, less hassle

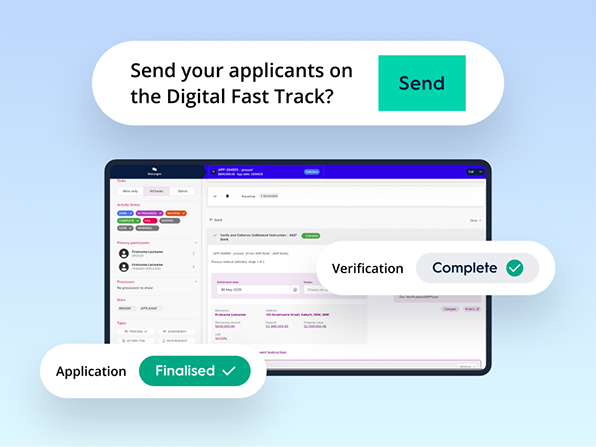

Say goodbye to uncertainty with our new broker platform. Our custom-built platform tackles the common pain points of the home loan process. With upfront income and expense verification, real-time credit and decisioning rules, and loan documents issued in just 90 seconds1, you’ll experience fewer reworks, faster decisions, and greater control over your applications.

From submission to settlement, the AMP Bank Broker Platform empowers you to deliver efficient outcomes—so you can focus less on admin and more on supporting your customers and growing your business.

With Income and expenses verified upfront and smart automation driving faster approvals, you can submit with confidence and keep things moving.

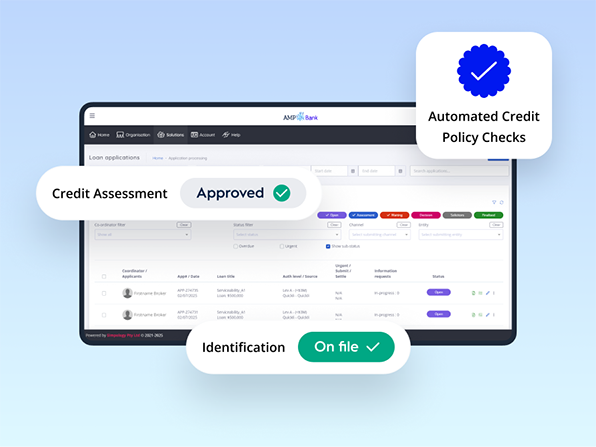

Credit policy checks upfront and seamless ID verification helps reduce rework and speed up approvals.

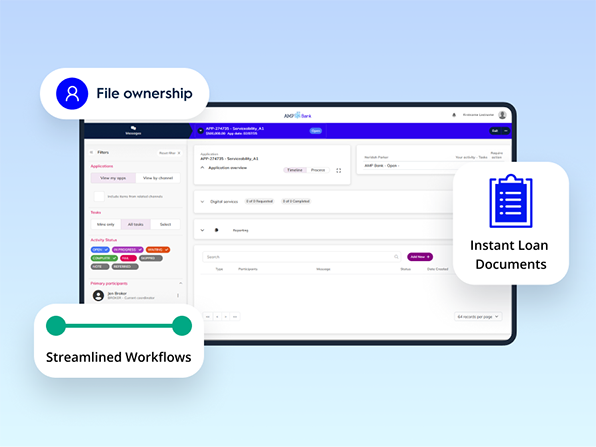

With instant loan docs, true file ownership and streamlined workflow, our settlement experience will deliver a faster, more seamless experience for your customers.

Key features

Get Faster, More Confident Decisions

Income verified before submission

PAYG and self-employed income as well as rental income can be digitally verified. PAYG Income can be verified via payroll providers or uploaded payslips and Self-employed via uploaded individual tax returns and Notice of Assessments - reducing manual checks.

Expenses verified before submission

Our platform will run rules over your customers’ declared expenses and guide you if any additional information is required.

Save Time and Reduce Rework

Automated Credit Policy Checks

Rules are run upfront, so you know if a deal meets policy before submission—reducing the chance of rework.

Targeted Credit Assessment

Credit assessors only review flagged or referred rules, meaning quicker approvals.

Seamless Identity Verification

Re-using the customer's previously completed identification information via ID Verse, removing duplication for you and your customer.

A Smoother Process from Start to Settlement

Instant Loan Documents

Issued to both broker and customer in just 90 seconds1 to get your customers off the market quicker.

True File Ownership

You will have a single contact at MSA National if you need to follow up anything to do with settlement

Streamlined Workflows

With fewer manual touchpoints, applications move faster, freeing you up to focus on your customers.

What do brokers think?

The platform is fresh, intuitive and helps get customers out of the market faster with less back and forth. Income is digitally verified, transperancy is high, and communication with credit assesors is seamless. Get on board - you’ll be missing out if you don’t.

Vasco Fonseca | Founder and Finance Manager - Five Dock Finance

This platform is incredibly intuitive. AMP bank has taken broker feedback seriously, and it shows. From automatic rental income verification through CoreLogic to docs in 90 seconds, it’s fast, efficient, and easy to use. Once you get consents signed, it’s smooth sailing - and a much better experience for the customer too.

Daniel Sotto | Finance Broker - Apex Financial Advisors

AMP Bank’s new broker platform is a game-changer. Verifying deals upfront saves time for brokers and credit assessors - and gives customers full confidence in their application. You could literally get approval and sign docs within your lunch break! It’s faster, clearer, and designed to make life easier for everyone involved.

Ollie Lum | Founder - Breathloans

Training Hub

Simpology

Created a customised version of Loanapp exclusively for AMP

Bank, which verifies as much of your data upfront, this results in faster application assessment, and decisions.

MSA National

Our new settlement partner, issuing loan documents in 90 seconds with true file ownership - so you always know the status of your application.1

Learn moreAMP Bank and Fortiro

We’ve partnered with Fortiro as part of our new broker platform to help digitise and automate the application process.

By accelerating income verification pre-submission, detecting fraud earlier and scaling lending decisions, Fortiro is helping us deliver a faster, smarter experience for brokers and customers alike.

Watch the video to learn more, or visit Fortiro’s website to read the full article here.

AMP Bank and Equifax

As part of the rollout of our new AMP Bank Broker Platform, we’ve partnered with Equifax Verification Exchange to streamline income and employment verification. This integration means faster approvals for brokers and their customers.

Through this integration, AMP Bank is introducing another way to verify income for PAYG applicants—reducing the time it takes to get to ‘yes’ and easing the burden of document collection.

Read the full article here

Important information

All information on this website is subject to change without notice. It's important your customers consider their particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination or Terms and Conditions before deciding what's right for them.

A target market determination for these products is available at distributor.amp.com.au/tmd

This information hasn't taken their circumstances into account. The credit provider and product issuer is AMP Bank Limited ABN 15 081 596 009, AFSL No 234517, Australian credit licence 234517.

1 General times only. Some situations may change this.