We're here to help

If your customers need help managing financially, AMP has a support hub where they can access a range of resources. Here are some different ways they can find what they're looking for.

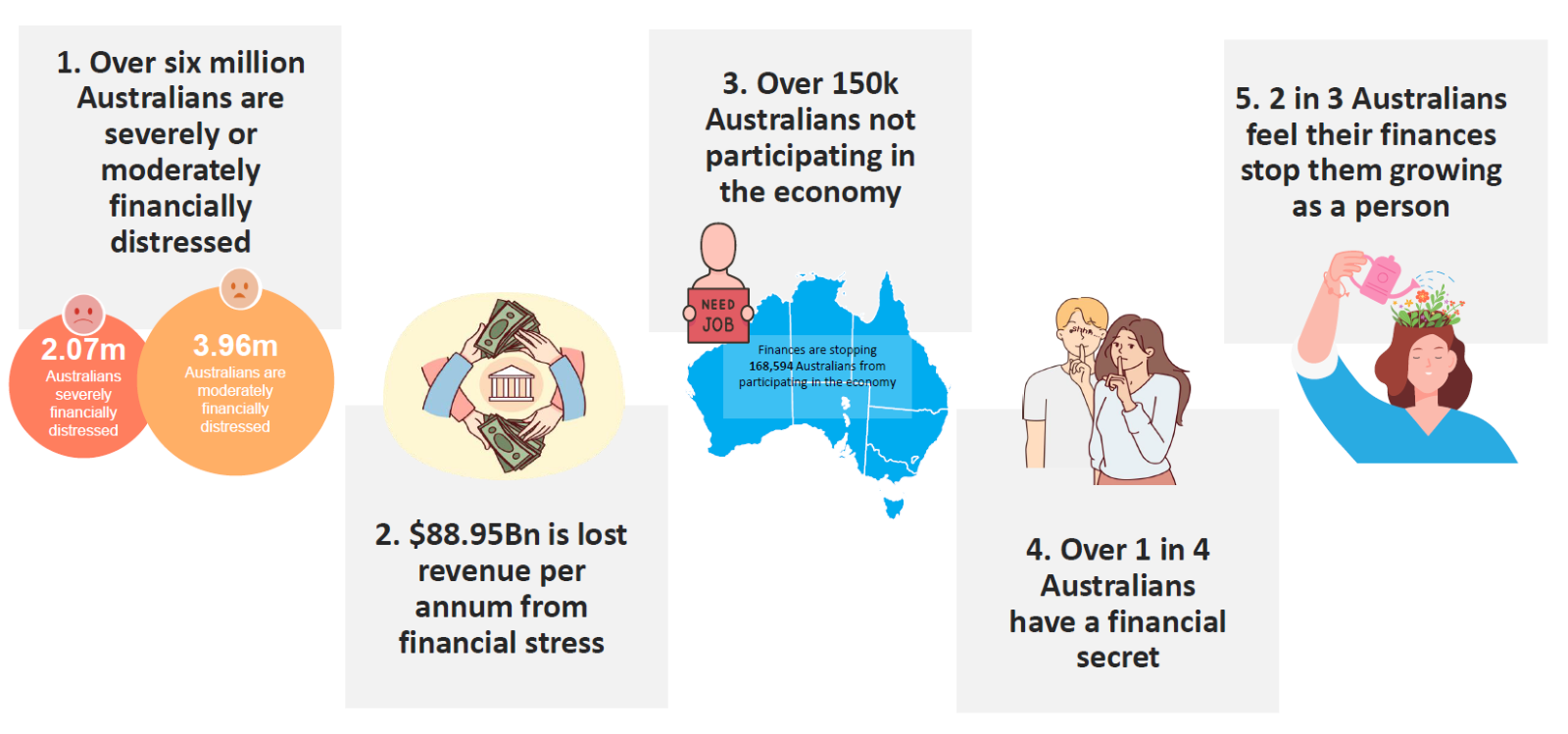

The AMP Financial Wellness Report 2024 is in. And the numbers paint a stark picture.

For generations the great Australian dream of home ownership has played a major role in our collective wellbeing, providing financial security into our old age.

So let’s look at how the report tells us we’re feeling about our homes and finances in 2024. Put simply, are we feeling good about owning a home or not?

After 13 interest rises in a row, many Aussie homeowners are still coming to terms with the ‘new normal’ of a higher rate landscape. Higher rates have affected all types of homeowner – those with variable rates endured regular increases, while many fixed rate homeowners had an unwelcome shock when they rolled off.

When you look at rate rises in the context of high inflation and cost-of-living pressure, it’s not surprising homeowners are feeling less than chipper.

But despite the challenges, there’s clear evidence that owning a home is still preferable to renting.

Renters might not have to focus so much on rate rises but they have other worries. Rents have been increasing and it can be tough to find a rental in the first place.

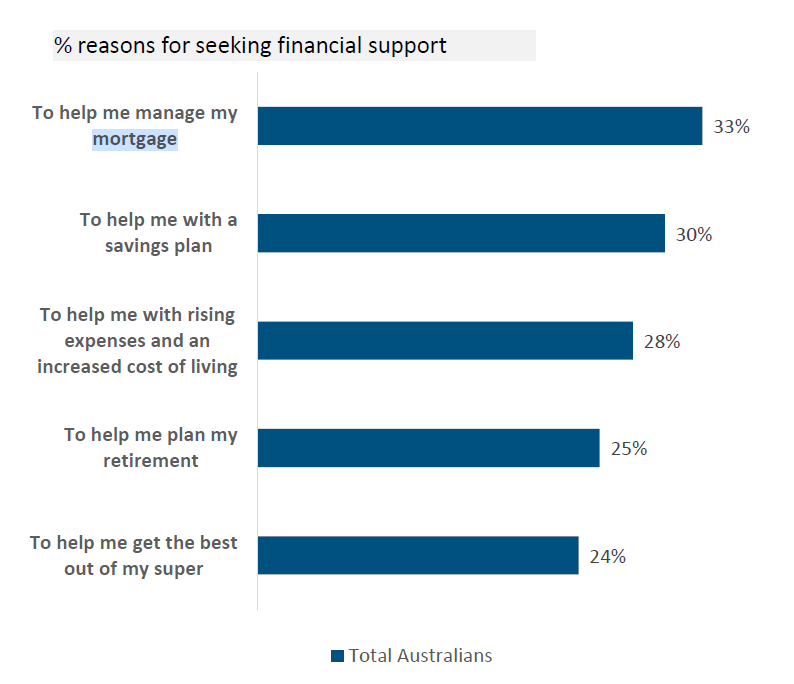

The good news is brokers can play a vital role in helping their customers navigate the changed rate landscape. When we asked Aussies their reasons for seeking financial support, the number one reason was helping to manage their mortgage.

If your customers need help managing financially, AMP has a support hub where they can access a range of resources. Here are some different ways they can find what they're looking for.

Mon - Fri: 8am - 8pm (AEST)

Sat and Sun: 9am - 5pm (AEST)

Mon - Fri: 8am - 8pm (AEST)

Important information

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you.

This information hasn’t taken your personal circumstances into account. This information is provided by AWM Services. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

All information on this website is subject to change without notice.

The credit provider and product issuer is AMP Bank Limited ABN 15 081 596 009, AFSL No 234517, Australian credit licence 234517. Approval is subject to AMP Bank guidelines. Terms and conditions apply and are available at amp.com.au/bankterms or by calling 13 30 30. Fees and charges are payable.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for all AMP Bank products is available on our TMD page.