SMSF lending is back

Welcome to the AMP Bank Broker Platform Training Hub

Everything you need to master our custom-built platform is right here—from live webinars and quick guides to step-by-step videos and real-time support.

For more details about the platform's features and the benefits it offers to you and your customers, please visit our AMP Bank Broker page here.

Training webinars

Register for one of our on-demand webinar training sessions where you'll receive access, gain insights into how the platform functions, and discover ways to optimise your submissions.

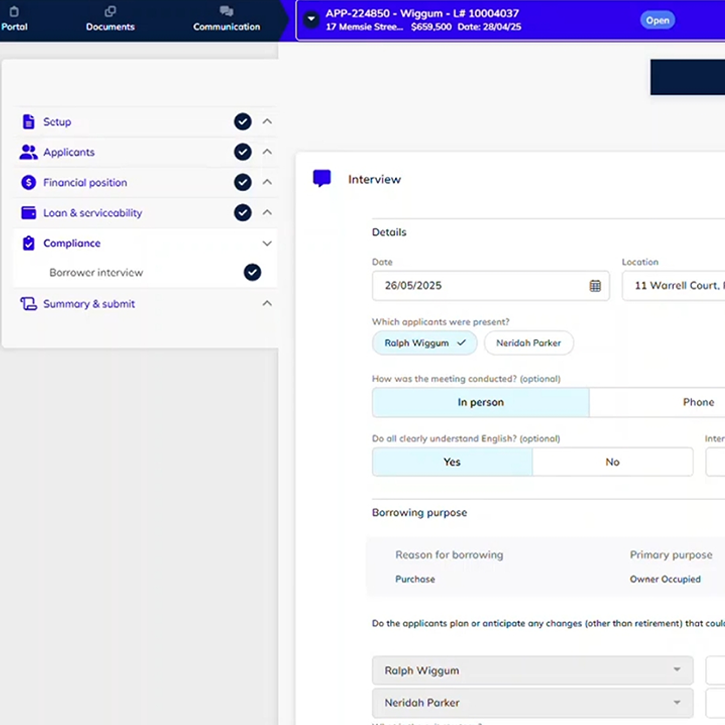

- Full platform walkthrough (best for beginners and full-process understanding).

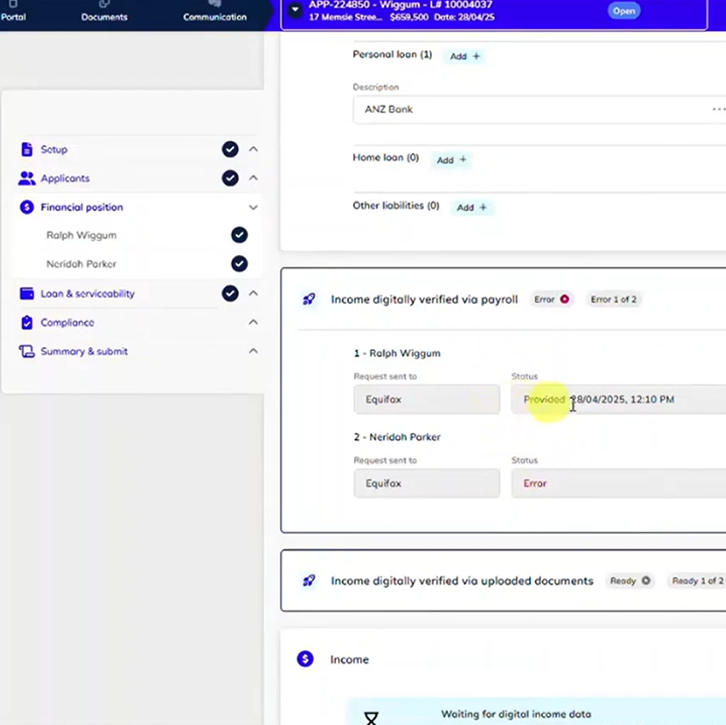

- Digital Income Drop In: Focus on digital income verification and reconciliation (best for those handling income documents).

- Info Requests & Supporting Docs Drop In: Focus on managing info requests and supporting docs (best for those managing application documentation).

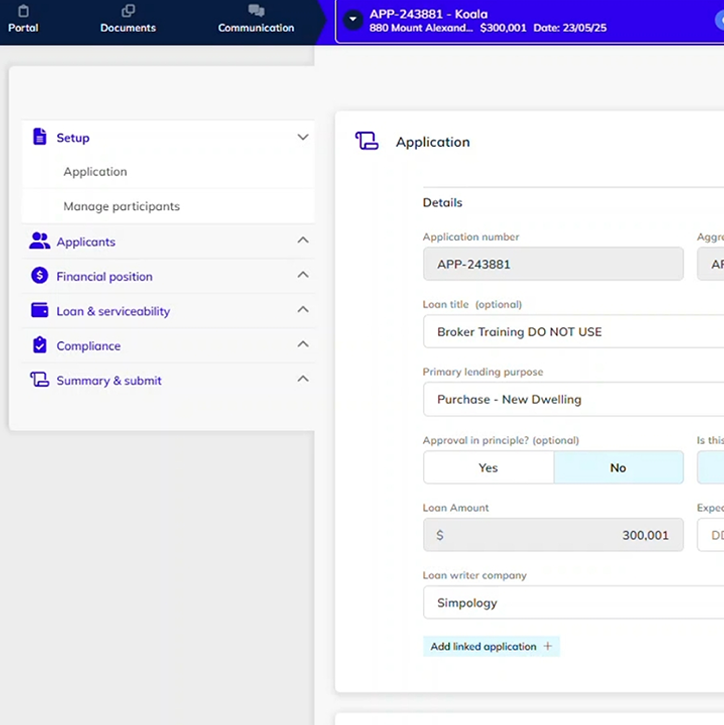

Get Started: AMP Bank Broker Platform Essentials Master the platform in 1.5 hr training session.

Full Platform overview and hands-on introduction to the entire new broker platform end to end.

Register hereMaster Digital Income Verification on the Platform in 30 mins Deep dive session

Deep dive into digital income verification features

Register hereMaster Info Requests & Supporting in 30 mins Deep dive session

Best practice for managing information requests and supporting documentation efficiently.

Register hereUseful Guides

Tips and hints

FAQs

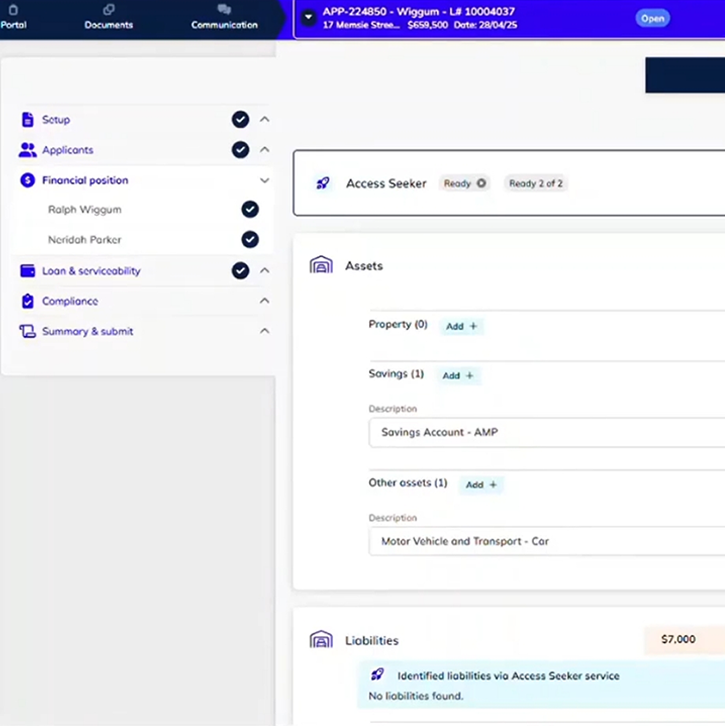

Pre Submission

This section will give you the tools to understand the pre submission process such has; verification of ID (VOI) process, income verification upfront, serviceability checks and other essential tips and hints to get faster outcomes for your customers.

Training PDFs

Useful links

Overall link to AMP Loanapp specific content:

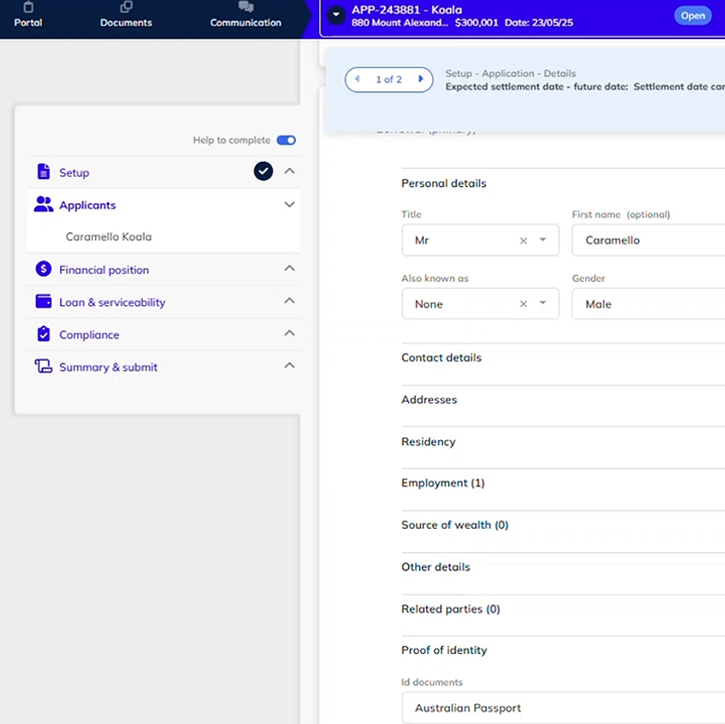

Digitally verifying your applicant in Loanapp

Digitally verifying your applicants employment income in

Loanapp

Digitally verifying your applicants Rental income in

Loanapp

AMPBank Serviceability Check | Simpology Loanapp

Serviceability Scenarios | Simpology Loanapp

Info Requests | Simpology Loanapp

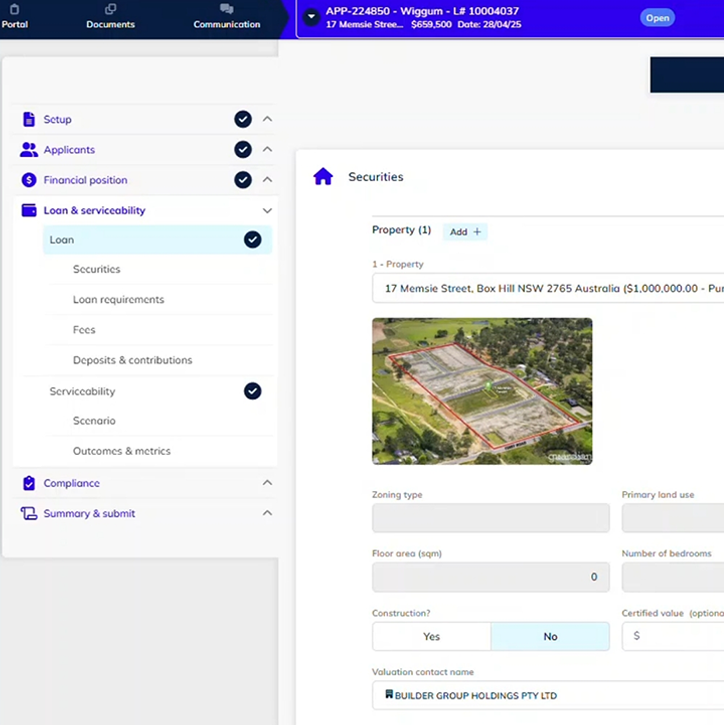

Order a valuation | Simpology Loanapp

Master Limit | Simpology Loanapp

Construction Loan | Simpology Loanapp

Requesting an Offset | Simpology Loanapp

Assessment to Settlement

This section offers valuable insights into credit assessment, conditional approvals, and settlement preparation, ensuring a seamless experience for you and your customers. We'll guide you on managing your in-flight pipelines and effectively communicating with teams at each stage of the application process. Additionally, we are partnering with MSA National, our new panel solicitor, to provide FAQs, contact points, and information on LoanTrak, all aimed at supporting a smooth settlement experience.

Training PDFs

Useful links

Broker and Customer Journey's

These reference guides provide a high-level overview of the end-to-end customer and broker journeys — from pre-submission through to post-settlement — highlighting key touchpoints and interactions along the way.

Self-paced Training Videos

Learn at your own pace with our short, on-demand training videos. Each module walks you through key steps on the AMP Bank Broker Platform—especially submitting loan applications—so you can build your skills quickly and work more efficiently, whenever it suits you.

SMSF Training content

Video training

Contact your BDM

Important information

All information on this website is subject to change without notice. It's important your customers consider their particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination or Terms and Conditions before deciding what's right for them.

A target market determination for these products is available at distributor.amp.com.au/tmd

This information hasn't taken their circumstances into account. The credit provider and product issuer is AMP Bank Limited ABN 15 081 596 009, AFSL No 234517, Australian credit licence 234517.